Business Analyst Estimation Techniques Guide | Free Estimation Template

A Business Analysts Guide to Estimation techniques (Short Summary)

This blog explores various methods used by business analysts to estimate project effort, time, and cost accurately. It starts by highlighting the importance of estimation in project planning and management, emphasizing its role in setting realistic expectations and ensuring project success. The blog then delves into specific estimation techniques commonly employed in business analysis, including Analogous Estimation, Parametric Estimation, and Three-Point Estimation. Each technique is explained in detail, outlining its principles, advantages, and limitations.

Moreover, practical examples are provided to illustrate how these techniques can be applied in real-world scenarios. Additionally, the blog discusses the significance of refining estimates iteratively throughout the project lifecycle, emphasizing the need for continuous evaluation and adjustment to account for changing requirements and unforeseen circumstances. Overall, the blog serves as a comprehensive guide for business analysts seeking to improve their estimation skills and enhance project planning and execution processes.

Detailed Blog

Welcome to the world of business analysis, where numbers meet strategy and insights drive decision-making. As a business analyst, you play a crucial role in shaping the trajectory of organizations by providing valuable estimates and forecasts. But how do you ensure accuracy and reliability in your estimations? That's where estimation techniques come into play!

In this blog post, we will dive deep into the realm of estimation techniques for a business analyst. We'll explore different methods, information sources, and factors contributing to accurate estimates. Whether you're a seasoned professional or just starting your career as a business analyst, this guide will equip you with the knowledge and tools needed to estimate project timelines, costs, resources, and more.

So grab your virtual calculator and join us on this exciting journey through the intricacies of estimation techniques for business analysts! Let's unlock the power of data-driven decision-making together!

What are Estimation techniques?

Estimation techniques in business analysis refer to a set of methods and tools analysts use to predict and quantify various aspects of a project or business initiative. These techniques help stakeholders make informed decisions, allocate resources effectively, and manage risks.

At its core, estimation involves making educated guesses based on available data and information. Business analysts need to employ reliable estimation techniques that provide accurate projections. This involves considering historical data, industry benchmarks, expert opinions, and the project's scope.

Business analysts can use different sources of information for estimation purposes. These may include past project data, industry reports, market research findings, expert interviews, or surveys. Analysts gain valuable insights that inform their estimations by gathering relevant data from these sources.

Various methods exist for conducting estimations in business analysis. Each method has its strengths and weaknesses depending on the nature of the project or initiative being analyzed. Some standard estimation techniques include top-down estimation (also known as macro-level estimating), parametric estimation (using statistical models), bottom-up/WBS (Work Breakdown Structure) estimation (breaking down tasks into smaller components), rough order of magnitude/expert opinion/ballpark estimates (based on experience), rolling wave estimates (iterative approach), Delphi technique (consensus-based estimate), PERT/Scenario analysis technique (optimistic/pessimistic/most likely scenarios).

Accuracy plays a vital role in estimates - it refers to how close an estimate is to the actual value or outcome. Precision also matters; it indicates consistency within repeated estimations given similar conditions but does not guarantee accuracy.

As a business analyst, using estimation techniques requires careful consideration of both artful interpretation of available data points with logical reasoning accompanied by thorough professional knowledge about methodologies explicitly related to your field; this will ensure successful outcomes across projects where uncertainties abound- ultimately leading to success only if appropriately managed so don't let them define your limits!

History of Estimation techniques

Estimation techniques in business analysis have a long and interesting history, evolving alongside the field. Historically, estimation was seen as more of an art than a science, with analysts relying on their intuition and experience to make educated guesses about project timelines and resource requirements.

However, as businesses became more complex and projects grew larger in scale, the need for more systematic approaches to estimation became apparent. This led to the development of various estimation techniques that could provide more accurate and reliable estimates.

One early technique that emerged in the 1950s is known as top-down estimation. This approach involves breaking down a project into smaller components and estimating each component individually before aggregating the results. While this method can provide quick initial estimates, it may lack detail or accuracy.

Another popular technique is bottom-up (or WBS) estimation, which involves creating a detailed work breakdown structure (WBS) for a project and estimating the effort required for each task. This method is often time-consuming but can result in more accurate estimates based on comprehensive planning.

In recent years, parametric estimation techniques have gained popularity due to technological advancements. These techniques use historical data or mathematical models to estimate future outcomes based on variables such as size, complexity, or past performance.

The Delphi technique is another commonly used method where multiple experts independently provide their estimates anonymously before reaching a consensus through iterative rounds of feedback. This helps reduce bias while leveraging collective expertise.

These various methods have evolved over time to cater to different needs within business analysis projects. By understanding their strengths and limitations along with considering factors like accuracy vs. speed trade-offs or available data sources, analysts can leverage these techniques effectively when making estimations

How Can Business Analysts Use Estimation Techniques?

As a business analyst, estimation techniques are crucial in your day-to-day activities. These techniques provide you with the tools to make informed decisions and set realistic expectations for project timelines, costs, and resources.

One way business analysts can use estimation techniques is during the planning phase of a project. Utilizing various methods, such as top-down or bottom-up/WBS estimation, you can break down the scope of work into smaller tasks and assign timeframes and resources accordingly.

Estimation techniques also come in handy when it comes to budgeting. You can accurately estimate the overall project cost by considering labor costs, materials, equipment, and overhead expenses.

Furthermore, these techniques are valuable in risk management. By conducting scenario analysis or using PERT (Program Evaluation Review Technique), you can identify potential risks and their impact on project timelines and budgets.

Another way that business analysts can leverage estimation techniques is by gathering information from reliable sources such as historical data, industry benchmarks, subject matter experts (SMEs), or even customer feedback. This ensures that your estimates are based on relevant information rather than relying solely on guesswork.

In conclusion

Estimation techniques are essential tools for business analysts as they enable them to provide realistic expectations regarding project timelines, costs, and resources. Whether it's breaking down tasks during planning, knowing how much a project will cost, budgeting effectively, risk management scenarios, or gathering information from reliable sources, the insights provided by these methods empower businesses towards success.

Through continuous refinement of these skills, your ability to accurately estimate will improve over time, giving you greater insight into projects' success potential.

Sources of information for estimation

Sources of information play a crucial role in the estimation process for business analysts. These sources provide the necessary data and insights required to make accurate estimations. But where can business analysts find these sources? Let's explore some common sources of information used for estimation.

One primary source is historical data, including past project records, performance metrics, and lessons from similar projects. This data helps analysts understand patterns and trends that can be applied to current estimations.

Subject matter experts (SMEs) are another valuable source of information. SMEs have extensive knowledge and experience in their respective fields, making them reliable resources for gathering relevant details about a project or task.

Documentation such as requirement specifications, design documents, and user manuals also provide essential information for estimation purposes. These documents outline the scope, functionality, and complexity of the project at hand.

Additionally, market research reports or industry surveys offer valuable insights into market trends, customer preferences, competitor analysis, and potential risks that may impact the estimation process.

Internal stakeholders like project managers or team leads can provide valuable input based on their understanding of resource availability and organizational constraints.

External factors such as legal regulations or government policies must be considered when estimating certain projects subject to compliance requirements.

By utilizing these various sources of information effectively while considering their strengths and limitations appropriately, business analysts can enhance the accuracy of their estimates while minimizing uncertainties tied to ambiguous inputs.

Methods of estimation techniques

There are various methods that business analysts can employ when it comes to estimation techniques. Each method has its unique approach and can be used in different situations depending on the project.

One commonly used method is top-down estimation. This technique involves breaking down the overall project into smaller components and estimating their individual costs or durations. It provides a high-level overview and is useful when limited information is available.

Another method is parametric estimation, which uses historical data and statistical models to estimate project parameters based on certain variables. This technique relies heavily on data analysis and requires accurate data for reliable estimates.

Bottom-up or work breakdown structure (WBS) estimation involves breaking down the entire project into detailed tasks and estimating each task individually. This method offers a more granular level of estimation but can be time-consuming due to its detailed nature.

Rough order of magnitude (ROM), expert opinion, or ballpark estimates are often made early in the planning phase when little information is available. These estimates rely on expert judgment and provide rough figures that help determine if further investment in the project is viable.

Rolling wave estimation takes an iterative approach by continuously refining estimates as more information becomes available throughout the project lifecycle. It allows for adjustments based on changing circumstances, increasing accuracy over time.

Delphi estimation involves obtaining input from multiple experts anonymously to avoid bias or influence. The experts provide their estimates independently, which are then consolidated through several rounds until a consensus is reached.

PERT (Program Evaluation Review Technique) or scenario analysis combines three time estimations - optimistic, pessimistic, and most likely - to calculate an average estimate with consideration for risk factors involved in each scenario.

These methods offer different approaches suited to various scenarios encountered by business analysts during their projects' lifecycle. By utilizing these techniques effectively, business analysts can improve their ability to provide accurate estimations crucial for successful organizational decision-making processes.

Top-down estimation

Top-down estimation is a common technique business analysts use to estimate project costs and timelines. It involves breaking down the overall project into smaller components and estimating each component individually before aggregating the results.

The process starts with an initial high-level estimate based on limited information, such as historical data or expert opinions. This top-level estimate serves as a baseline for further refinement.

Once the initial estimate is established, the analyst can drill down into more specific details, estimating each component separately. This allows for greater accuracy and granularity in the final estimation.

One advantage of top-down estimation is its simplicity and efficiency. Focusing on the big picture first helps identify potential risks and dependencies early on in the project planning phase.

However, one limitation of this technique is that it may not capture all nuances or variations within individual components. It relies heavily on assumptions and may overlook certain complexities that could impact estimates later on.

Top-down estimation provides a valuable starting point for project planning but should be supplemented with other techniques to ensure comprehensive coverage of all aspects involved. Combining different approaches allows business analysts to achieve more accurate estimations and better manage expectations throughout the project lifecycle.

Worked out example:

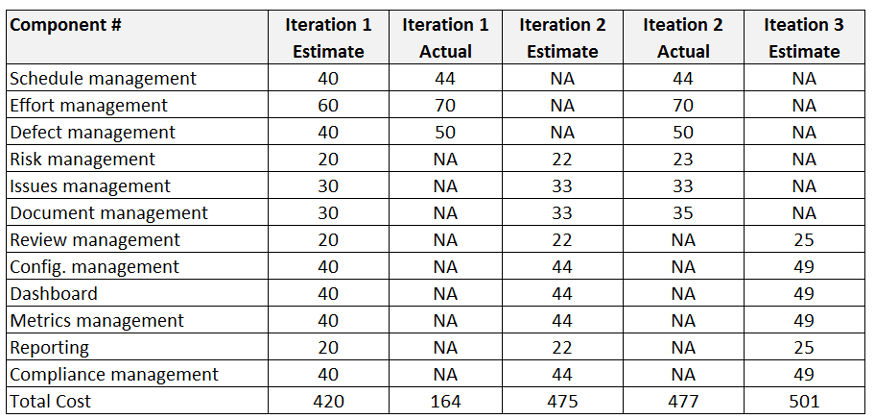

Estimate efforts for components using hierarchical breakdown. Used when the budget is fixed.

Example:

Parametric estimation

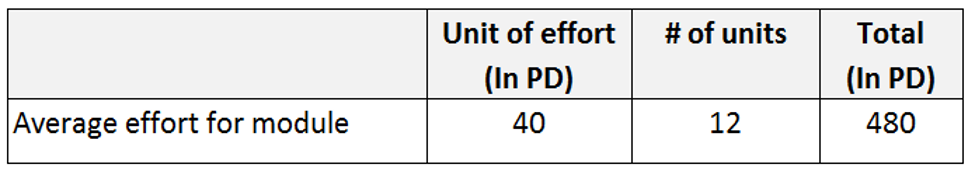

Parametric estimation is a widely used technique in business analysis for estimating the effort, time, or cost required to complete a project. Unlike other techniques that rely on historical data or expert judgment, parametric estimation uses mathematical formulas and statistical models to make estimates.

Analysts identify key parameters or variables that influence a project's outcome in parametric estimation. These variables can include size, complexity, resources needed, and productivity rates. Analysts develop mathematical models that can be applied to new projects by analyzing historical data and trends related to these variables.

One of the advantages of parametric estimation is its ability to provide quick estimates based on limited information. It allows business analysts to make informed decisions early in the project planning phase when detailed requirements are unavailable.

However, it's important to note that parametric estimation relies heavily on accurate historical data and assumptions about future conditions. If these assumptions are incorrect or if there are significant differences between past projects and current ones, the accuracy of the estimates may be compromised.

Overall, "parametric estimation" is a powerful tool for business analysts looking for efficient ways to estimate project efforts accurately without relying solely on subjective judgments or guesswork. Leveraging mathematical models based on empirical data can improve their estimations' precision and reliability.

Worked out example:

Uses a calibrated parametric model of element attributes. For example, if 1 use case takes 3 days to develop, it will take 60 days to develop 20 business analysts' use cases. Estimate = Sum (fi*xi)

Example:

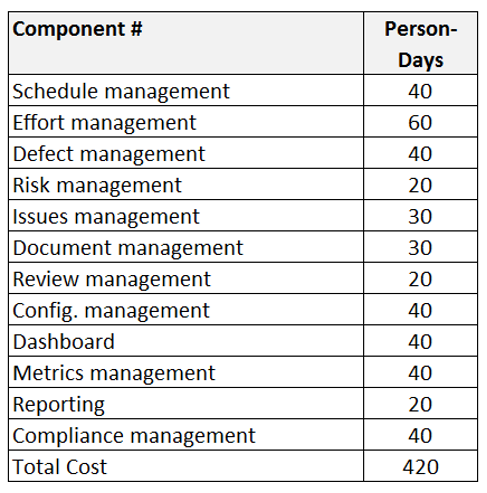

Bottom-up/ WBS estimation

Bottom-up estimation, also known as Work Breakdown Structure (WBS) estimation, is a widely used technique in business analysis. It involves breaking down a project into smaller tasks or work packages and estimating the required effort for each task. By analyzing the finer details of each component, this approach provides a more accurate estimate.

The key advantage of bottom-up estimation is its granularity. Breaking down the project into smaller pieces allows for a more precise assessment of resources, timeframes, and costs involved at every level. This method ensures that no aspect of the project is overlooked or underestimated.

To apply bottom-up estimation effectively, business analysts rely on the expertise and input from various stakeholders, such as subject matter experts, team members, and other relevant parties. This collaborative effort ensures that all perspectives are considered when determining estimates for different components.

By using WBS estimation techniques, business analysts can gain greater visibility into the intricacies of a project and avoid potential pitfalls by identifying potential risks early on. It enables them to create an accurate roadmap for successful implementation while ensuring alignment with organizational goals.

Bottom-up/WBS estimation empowers business analysts to make informed decisions based on detailed insights gathered from all levels of the project hierarchy.

Worked out example:

Uses WBS to estimate deliverables, activities, tasks, and estimates from stakeholders and rolls them up to get a total. It is easier to estimate smaller items than larger items. Bottom-up estimating produces MOST accurate and defensible estimates.

Example:

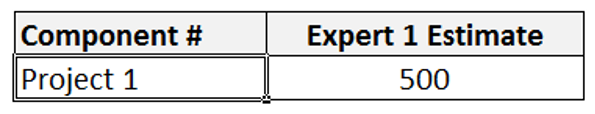

Rough order of magnitude (ROM)/Expert opinion /ballpark

Rough order of magnitude (ROM)/Expert opinion/Ballpark estimation is widely used by business analysts to provide a quick and high-level estimate for project planning purposes. This estimation method relies heavily on the expertise and experience of the analyst, making it subjective in nature.

When using ROM estimation, the business analyst gathers information from various sources, such as historical data, industry benchmarks, and expert opinions. The goal is to provide a rough idea of the project's cost or duration without going into too much detail.

While ROM estimates are not highly accurate or precise due to their broad nature, they serve as a valuable starting point for decision-making. They help stakeholders get an initial understanding of what to expect in terms of timeframes and costs.

However, it's important to note that biases or personal opinions can influence ROM estimates. Therefore, business analysts must gather input from multiple experts and maintain transparency throughout the estimation process.

Although Rough Order of Magnitude (ROM) estimation may lack precision and reliability compared to other techniques, it provides a quick approximation that aids project planning. By leveraging expert opinions and considering various factors influencing costs or durations, business analysts can deliver ballpark figures that assist stakeholders in making informed decisions.

Worked out example:

A high-level estimate with a very wide confidence interval. Typically based on history or expert judgment with limited information. [Early phase of the project.]

Example:

Rolling wave

Rolling wave estimation is a technique commonly used by business analysts to estimate project effort and duration. It involves breaking down the requirements and tasks of a project into smaller, more manageable chunks, which are then estimated in detail for the immediate future while leaving the later stages with broader estimates.

By applying rolling wave estimation, business analysts can prioritize their efforts on current and near-term activities while allowing flexibility for adjustments as the project progresses. This method recognizes that detailed estimations are not always accurate or feasible for long-term planning due to changing circumstances or uncertainties.

The rolling wave approach allows businesses to adapt to evolving conditions by continuously re-evaluating estimates as new information becomes available. It enables stakeholders to make informed decisions based on real-time data rather than relying solely on initial projections.

Furthermore, this technique promotes collaboration among team members by encouraging regular communication and feedback loops throughout different project phases. By maintaining an iterative process of estimating and adjusting, business analysts can enhance accuracy and reduce risks associated with inaccurate predictions.

Rolling wave estimation gives businesses greater flexibility and adaptability in their planning processes. By embracing this technique, business analysts can ensure more accurate estimations while maintaining agility in response to changing market dynamics or evolving stakeholder needs.

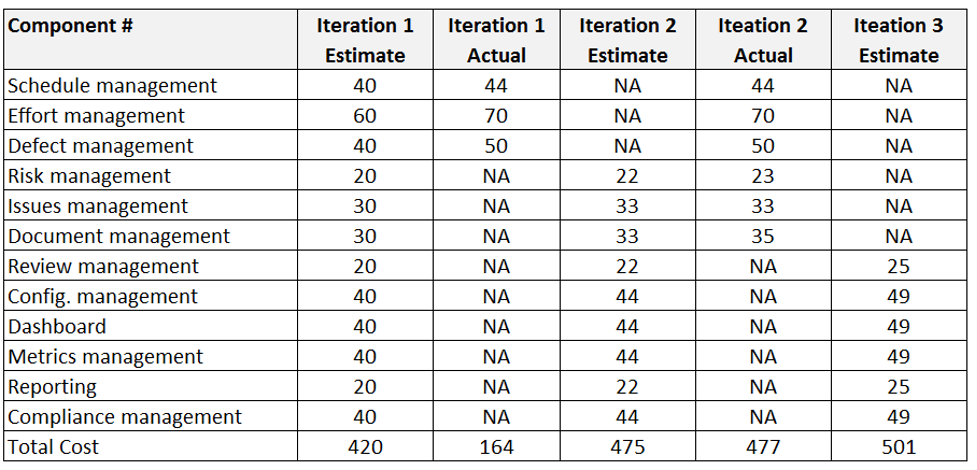

Worked out example: Continual refinement of estimates. Estimate activities in the current iteration and extrapolate it for the entire scope of work. After each iteration, re-estimate future activities.

Example:

Delphi estimation

Delphi estimation is a powerful technique business analysts use to arrive at more accurate estimates. It takes its name from the ancient Greek Oracle of Delphi, known for providing wise and insightful predictions. In this method, a group of experts or stakeholders are individually asked to provide their estimates on a particular project. These individual estimates are then collected, summarized, and shared anonymously with the group.

The participants can review the collective estimate and provide additional input or revise their own estimate based on this feedback. This iterative process continues until consensus is reached among the participants. The anonymity allows for unbiased opinions without any influence from dominant personalities or hierarchies within the group.

Delphi estimation is particularly beneficial when dealing with complex projects or uncertain circumstances with multiple perspectives and uncertainties. By harnessing the collective wisdom of diverse experts, businesses can derive more reliable estimations that consider different viewpoints and potential risks.

One key advantage of Delphi estimation is that it encourages open communication among participants while maintaining confidentiality. This fosters collaboration between individuals with differing opinions but working toward a common goal. Additionally, it reduces biases that can arise from hierarchical structures within organizations.

However, like any estimation technique, Delphi estimation also has its limitations. It requires significant time investment as multiple rounds of feedback and revision are needed to reach a consensus. Moreover, it heavily relies on expert judgment, which may still be subject to individual biases despite efforts to maintain anonymity.

In conclusion, Delphi estimation offers an effective way for business analysts to tap into collective expertise to arrive at more accurate estimations for complex projects or uncertain situations. Its collaborative nature promotes unbiased decision-making while considering various perspectives within an organization or stakeholder group.

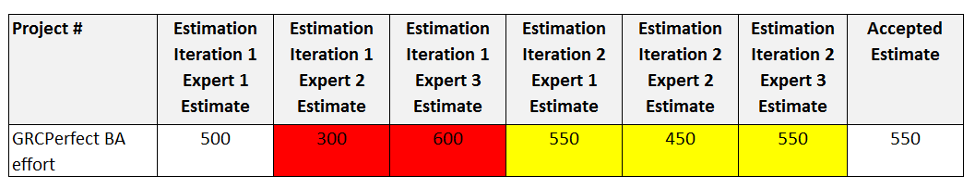

Worked out example: Uses a combination of expert judgment and history. Include individual estimates, share estimates with experts, and have several rounds until a consensus is reached.

Example:

PERT (Program Evaluation Review Technique) / Scenario analysis

PERT (Program Evaluation Review Technique) is a widely used estimation technique in business analysis. It was developed during the 1950s by the United States Navy as part of their Polaris missile project. PERT combines elements of network analysis and statistical techniques to provide a more accurate estimate of project duration.

Analysts break down a project into smaller tasks or activities in PERT and determine their dependencies. This helps identify the critical path, which is the sequence of activities that must be completed on time for the project to stay on schedule. Analysts can calculate an expected duration using probability theory by assigning optimistic, pessimistic, and most likely estimates to each activity.

Scenario analysis is another useful tool for estimating project timelines. It involves considering different scenarios or possible outcomes based on various factors such as resource availability, external influences, and risks. Analysts can create best-case, worst-case, and most-likely scenarios to understand the potential range of outcomes.

Combining PERT with scenario analysis allows business analysts to better account for project uncertainties. By considering multiple possibilities and their respective probabilities, they can provide stakeholders with more realistic estimates that account for both optimistic and pessimistic scenarios.

However effective these techniques may be when used correctly, it's important to note that estimation will always have limitations due to unforeseen circumstances or changing requirements throughout a project's lifecycle.

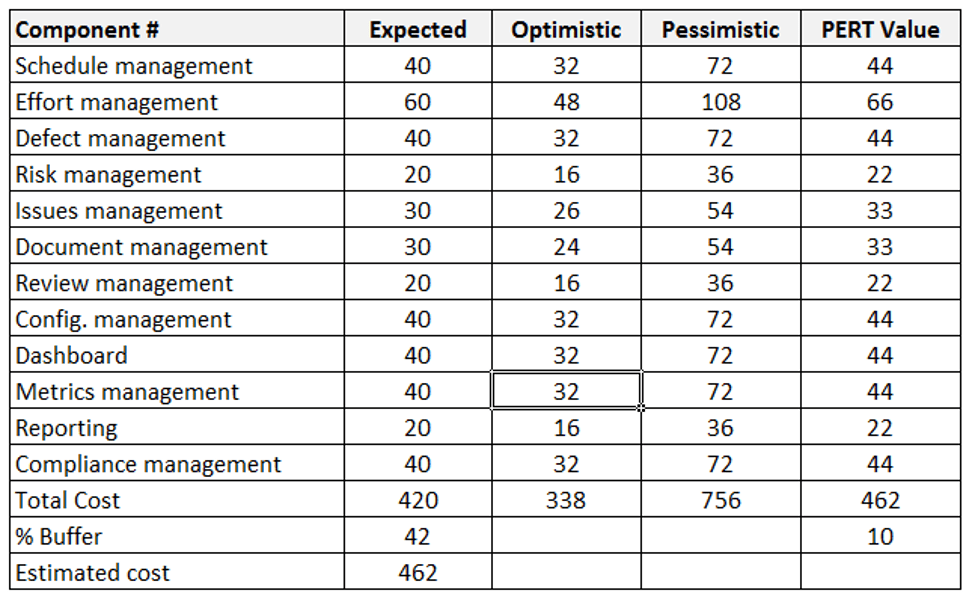

Worked out example:

Each component of the estimate has 3 values:

(M) Most likely estimate (3 days)

(O) Optimistic or best-case scenario (2 days)

(P) Pessimistic or worst-case scenario (7 days)

The most likely estimate is NOT an average of best- and worst-case scenarios.

PERT estimate:

(1 * Optimistic + 1 * Pessimistic + 4 * Most likely)/6 = (4*3+2+7)/6 = 3.5

Example:

Accuracy of an estimate

The accuracy of an estimate is a crucial factor in the world of business analysis. It determines how close the estimated value is to the actual value. Accuracy plays a significant role in decision-making processes, resource allocation, and project planning.

Business analysts must consider various factors impacting their estimates to ensure accuracy. These factors include data quality, assumptions made during estimation, historical information availability, and expertise level. The more accurate the data used for estimation, the higher the chances of achieving an accurate estimate.

It's important to note that accuracy does not imply precision or reliability. Precision refers to how closely multiple estimates align with each other, while reliability measures consistency over time or across different scenarios.

Business analysts can enhance accuracy by using proven techniques such as top-down or bottom-up/WBS estimations. Top-down estimation involves breaking down high-level estimates into smaller components, whereas bottom-up/WBS estimation begins with individual tasks and aggregates them into larger estimates.

Another approach for improving accuracy is through scenario analysis, where different possible outcomes are considered based on varying assumptions and conditions. This helps identify potential risks and uncertainties that may impact the final estimate.

Accurately estimating values is vital for effective decision-making in business analysis. By considering various sources of information and using appropriate methods like top-down or bottom-up estimations along with scenario analysis techniques such as PERT or Delphi estimations, business analysts can improve their ability to provide reliable estimates needed for successful project planning and execution

Precision and reliability of estimates

Precision and reliability are crucial aspects of estimation techniques in business analysis. Precise estimates indicate accuracy, while reliable estimates provide a level of confidence in the final outcome.

To achieve precision, business analysts must ensure their estimations are as accurate as possible. This requires gathering relevant data and information from various sources, such as historical project data, industry benchmarks, subject matter experts, and stakeholders. Analysts can make more informed estimates by leveraging this diverse range of inputs.

Reliability refers to the consistency and dependability of an estimate. Business analysts should consider using multiple estimation methods or techniques for cross-validation to enhance reliability. This helps reduce bias and increases the overall trustworthiness of the estimate.

Furthermore, conducting sensitivity analysis can also contribute to improving reliability by examining how changes in key variables impact the estimated outcomes. Analysts can adjust their approach by identifying potential risks or uncertainties that might affect the estimate's validity early on.

Business analysts must effectively communicate their estimates' precision and reliability levels. Providing clear explanations about underlying assumptions made during the estimation process allows stakeholders to understand potential limitations or constraints.

Achieving precision and reliability in estimating requires diligent research and careful consideration of various factors influencing the desired outcome. Business analysts play a critical role in ensuring that estimations are accurate enough for decision-making purposes while providing stakeholders with confidence in those estimates' dependability

Contributors to estimates

Contributors to estimates play a vital role in the accuracy and reliability of estimation techniques business analysts use. These contributors can come from various sources within an organization or project team. One important contributor is historical data, which provides insights into past projects and their outcomes. Business analysts can make more informed estimations for future projects by analyzing this data.

Subject matter experts (SMEs) are another key contributor to estimates. Their expertise in specific areas allows them to provide valuable insights and knowledge that can be used for estimation purposes. SMEs can offer input on factors such as task complexity, resource requirements, and potential risks.

Stakeholders also have a significant impact on estimates. Their involvement ensures that all relevant perspectives are considered during the estimation process. They may provide inputs related to project goals, priorities, constraints, and expectations.

Additionally, industry benchmarks and standards contribute to estimation techniques by providing reference points for similar projects or initiatives. These benchmarks help align estimations with industry best practices and ensure more accurate predictions.

External parties such as consultants or vendors may also contribute their expertise when estimating certain aspects of a project that fall outside the scope of internal resources' capabilities.

Business analysts must consider these various contributors when applying estimation techniques to arrive at reliable estimates that reflect real-world conditions accurately

Strengths of Estimation techniques

Estimation techniques play a crucial role in the field of business analysis, providing valuable insights and helping professionals make informed decisions. These techniques offer several strengths that contribute to their effectiveness.

One of the major strengths of estimation techniques is their ability to provide a structured approach to estimating project parameters. Business analysts can ensure consistency and accuracy in their estimates by following established methods. This allows for better planning and resource allocation.

Another strength is that estimation techniques enable businesses to assess the feasibility of projects before investing significant resources. By estimating costs, timelines, and risks, organizations can evaluate whether a particular initiative aligns with their strategic goals and if it is worth pursuing.

Estimation techniques also facilitate effective communication among stakeholders. When everyone involved clearly understands the estimated outcomes and requirements, it becomes easier to collaborate, prioritize tasks, and proactively address potential challenges.

Furthermore, these techniques allow for flexibility in decision-making by considering various scenarios. Business analysts can use different estimation methods to explore multiple options or create contingency plans based on best-case or worst-case scenarios.

Estimation techniques help improve project management by providing realistic expectations for both teams and clients alike. With accurate estimations at hand, all parties involved can set achievable goals and avoid unnecessary delays or budget overruns.

Overall, the strengths exhibited by estimation techniques showcase their value as essential tools in business analysis.' Their systematic approach fosters better planning communication between stakeholders and enables improved decision-making. By implementing these strategies, organizations can enhance project management and achieve successful outcomes

Limitations of Estimation techniques

While estimation techniques are valuable tools for business analysts, it's important to recognize their limitations. One limitation is the potential for bias in the estimates. Analysts may unintentionally overestimate or underestimate certain factors based on their own experiences or preferences.

Another limitation is the reliance on historical data. Estimation techniques often require past project data to predict future projects accurately. However, the estimates may be unreliable if there isn't enough relevant data available or if circumstances have changed significantly since previous projects.

Estimation techniques also assume a level of stability and predictability in the project environment. Projects can be complex and dynamic, with many variables and uncertainties that can impact timelines and costs. This unpredictability makes it challenging to estimate project outcomes accurately.

Furthermore, estimation techniques often disregard external factors beyond the control of the business analyst or project team. Economic fluctuations, regulatory changes, and market trends can all influence project outcomes but may not be adequately accounted for in estimation techniques.

Additionally, estimations are only as good as the information available at any given time. If key information is missing or incomplete during the estimation process, it can lead to inaccurate projections.

Estimating too early in a project's lifecycle can introduce significant uncertainty into estimates due to a lack of detailed requirements and scope definition.

Business analysts need to understand these limitations when using estimation techniques to make informed decisions about estimating a project's timeline and resources.

Conclusion

Estimation techniques are vital tools for business analysts in accurately predicting project timelines, costs, and resources. By utilizing these methods effectively, analysts can provide valuable insights to stakeholders and contribute to the overall success of a project.

Throughout history, various estimation techniques have been developed and refined to meet the evolving needs of businesses. Each method offers unique benefits and limitations, from top-down and bottom-up approaches to parametric estimation and Delphi techniques.

Business analysts can leverage a range of sources, such as historical data, domain expertise, industry benchmarks, or expert opinions, when gathering information for an estimate. This ensures that their estimates are based on relevant data points and align with organizational goals.

Accuracy is essential in estimations; however, it's important to understand that estimates are not precise predictions but rather educated assessments of future outcomes. The precision and reliability of an estimate depend on several factors, such as available data quality, level of detail in analysis, team expertise, and assumptions made during the process.

Contributors to estimates include project complexity levels, resource availability constraints, or dependencies among tasks. Business analysts increase their chances of providing accurate estimates by considering these factors carefully and involving key stakeholders throughout the estimation process.

Estimation techniques offer several strengths, including improved decision-making processes by providing a realistic view of projects' scope, schedule, budgets, etc., facilitating effective communication between stakeholders, reducing risks associated with uncertain planning cost overruns, and enabling better allocation of resources based on credible projections.

Using estimation techniques enables business analysts to build a solid foundation for successful projects. It helps them make informed decisions, and their teams allocate resources appropriately within budgetary constraints. The goal is to balance achievable targets and stakeholders' expectations.

You May Also Like

These Related Stories

Top 10 BA Estimation Techniques | Adaptive US

BA estimation - Theory vs. Practice | Free Est. Template

No Comments Yet

Let us know what you think